Budget 2025 has been announced in the Dáil made up of a total package of €8.3bn.

The funding is comprised of €1.4bn in taxation measures and new expenditure of €6.9bn.

Schoolbooks have been made free, vapes will be taxed for the first time and the Universal Social Charge has been cut.

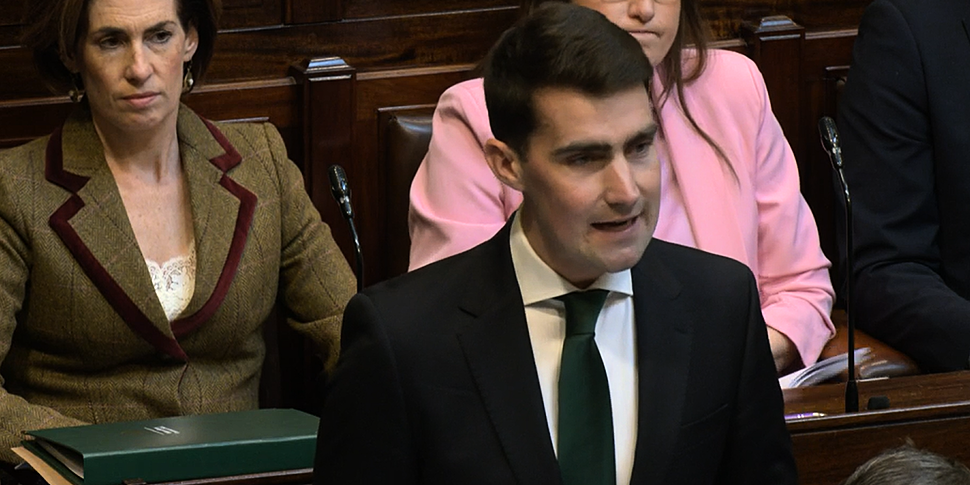

"Today’s Budget is my first and it is also unique in the opportunity it presents to plan, transform and deliver for the future," Finance Minister Jack Chambers said.

"That future is not just about next month, next year or the next decade, it is about ensuring that the children born today in Ireland and every day from here on can live prosperous and fulfilled lives.

"But we also need to give hope to young people now and to their families, their parents and grandparents whether living here in Ireland or abroad that the decisions being made today will help them afford a home of their own," he added.

He said Budget 2025 "puts the country on a firm footing for the future" - singling out the areas of housing, energy, water and transport infrastructure.

Public Expenditure Minister Paschal Donohoe said the Government has agreed the €14.1bn Apple tax money should be used across "water, electricity, transport and housing" as four key pillars.

He added that an investment framework is being developed in coordination with the National Development Plan.

Here are the main points from Budget 2025:

Taxes and wages

- Main tax credits will increase by €125 on personal, employee and earned income

- Higher rate of tax rises €2,000 to €44,000

- Universal Social Charge (USC) will see the 4% rate reduced to 3%

- National minimum wage to rise by 80c to €13.50 an hour from January 1st 2025

- Entry rate to 3% rate of USC will rise to €27,000

- The changes mean a full-time worker on the minimum wage will see their net income rise by €1,424 annually

- Inheritance Tax is increasing from €335,000 to €400,000 from a parent - €32,500 to €40,000 for Group B and €16,250 to €20,000 for Group C

- The exception to allow employers to give employees vouchers or other non-cash rewards is increasing from €1,000 to €1,500 a year

Credits and social welfare

- Increase in the Carer Tax Credit by €150

- Single person Child Carer Credit increasing by €150, Incapacitated Child Credit increasing by €300, Dependent Relative Credit by €60

- Blind Tax Credit to increase by €300

- €250 electricity credit in two parts - one before the end of the year and one after

- €300 lump sum payment to those on the Fuel Allowance in November

- €200 extra on the Living Alone Allowance

- €400 to those on Carers Support Grant, Disability Allowance, Blind Pension, Invalidity Pension and Domiciliary Care Allowance

- Increase to Carers Allowance Disregard to €625 for a single person and €1,250 for a couple

- Increase to Domiciliary Care Allowance by €20

- Increasing Carers Support Grant by €150

School and families

- School transport fee reduction and State exam fee waiver to continue

- €1,000 reduction on Student Contribution Fee

- Once-off 33% in the contribution fee for higher education

- Increase in the Post Grad Tuition fee by €1,000 for student grant recipients

- Maternity, paternity, adoptive and parents leave rise by €15

- Hot School Meals Programme increases to all primary schools in 2025

- A Baby Bonus of €420 to be paid for each newborn child

- An October and a Christmas social welfare double payment will be made

- Two double payments of Child Benefit will happen in November and December

- €400 lump sum on the Working Family Payment this year

- National Childcare Scheme budget to increase 44% leading to full time childcare costs reducing by an average of 1,100 a year

- €336m increase in money for disability services for extra residential care beds, respite, home support hours

- 1,600 new SNAs and 768 special education teachers to be recruited

- Money to keep schools smartphone free and allow them to buy tech to do that

- Free schoolbooks extended to all secondary schools

Health

- 495 new beds to the health service

- 600,000 home support hours extra

- Increased free IVF and new free HRT

- Payments to women under the Cervical Check payment scheme will be exempt from tax

Housing and renting

- €3.2bn announced in capital funding for the housing sector

- 10,000 new build social homes at a cost of €2bn in 2025

- €680m for key affordable housing schemes

- 10,000 new households under the HAP and RAS schemes in 2025

- €90m to retrofit some 2,500 social homes in 2025

- The Help to Buy scheme is being extended until the end of the decade

- Pre-letting expenses relief for landlords is being extended to the end of 2027

- The 9% rate of VAT on gas and electricity is being extended six months to April 30th 2025

- Warmer Homes Grants will reach 10-times the funding from 2020 and will meet up to half the cost of energy efficiency upgrades

Duties and levies

- Stamp Duty on bulk purchases of homes by investment funds rises from 10% to 15%.

- The bank levy will be extended for another year with estimated yield of €200m

- There will also be increased Stamp Duty on high-value residences

- From tonight there will be a 6% rate of Stamp Duty on properties worth more than €1.5m - with rates 1% up to €1m, 2% of up to €1.5m, 6% over €1.5m

- Vacant Homes Tax to rise from 5% to 7%-times the Local Property Tax rate from November

- Carbon Tax will increase on October 9th from 56c to 63.50c for petrol and diesel

- The Motor Insurers Insolvency Levy will be reduced from 1% to 0% from January 1st 2025

Excise

- A packet of 20 cigarettes is going up by €1 from midnight with a pro-rata increase on other tobacco products

- This brings the price of the most popular pack to €18.05

- A tax on e-cigarettes will be introduced at a rate of 50c per millilitre of liquid

- The typical vape has 2ml so average price will go from €8.00 to €9.23 from the middle of next year

Transport

- Temporary fare reductions of 20% for adults and the Young Adult card reduction of 50% reduction will continued

- Free public transport to those under 9

- Those over 70 will be able to travel with another person for free

- A financing agreement to extend the Port of Cork's quay side berth at Ringaskiddy has been agreed

Business

- Introduction of a partial exemption for foreign dividends for companies

- Increase in the first year of the R&D tax credit from €50,000 to €75,0000

- Doubling the Employment Investment Incentive from €500,000 to €1m

- Increasing reliefs on startups for entrepreneurs

- A new relief for expenses incurred with listing on the Irish or European stock exchange with a cap of €1m

- Tax credit on unscripted production at a rate of 20% on expenses of up to €15m for the audiovisual sector

- €20m for film productions under the 481 Tax Credit

- The excise relief on small cider and perry producers extended

- A new Energy Subsidy Scheme for businesses worth €170m for 39,000 firms has been agreed

Farming

- Extension to 2027 of the general stock relief, stock relief for young trained farmers, stock relief for registered farm partnerships

- Flat rate scheme for farmers being raised from 4.8% to 5.1%

- There will be an option for farmers and others who might be impacted by the Residential

- Zoned Land Tax to apply for a 2025 exemption if they want the land re-zoned to reflect work carried out

- €2bn announced for agriculture made up of €30m for a new Tillage Scheme to support field crops

- €10m for animal health measures

- €22m for the National Sheep Welfare Scheme

- €8m to enhance payment rates on the National Beef Welfare Scheme

Justice and Defence

- 350 extra staff for the Irish Prison Service

- 1,000 additional Gardaí and 50 civilian Gardaí

- 400 additional staff for the International Protection processing system

- €7m for organisations tackling gender and domestic violence

- 22% increase in the capital money for defence to invest in military radar and subsea surveillance projects

- 400 extra Defence Force members in 2025

Arts and Media

- €380m allocated to arts and culture

- €107m for the Gaeltacht

- €226m to tourism

- €328m in media funding - including €6m for the Independent broadcasting sector

Read the Minister's speeches in full here